2022 saw continued growth in Argidius’ impact and the cost effectiveness at which this is achieved. Our learning agenda has allowed us to discover what works best to help entrepreneurs grow. This includes evaluating the design and implementation of advice, training and support. This learning is being leveraged to improve the effectiveness of much larger bilateral donor agencies, ministries and institutions.

This year’s review focuses on a related but different type of leverage: access to finance. Projects supported by Argidius have leveraged almost €2 billion in finance for SMEs, at a ratio of €30 for every €1 of Argidius support, and €7.9 to €1 factoring in contributions levered from our project co-funders. In today’s tightening fiscal space, it’s more important than ever that each euro generates as much impact as possible.

This chapter highlights four key lessons required to address capital constraints that hold back the growth of SMEs, and the crucial job creation and inclusive economic development which they drive.

A quick history

Argidius was one of a number of players who made a valuable contribution from the 1960s into the 1990s supporting the emergence and establishment of microfinance (now called financial inclusion). This effort involved significant levels of grant and subsidy to develop new financing models and institutions. The financial inclusion sector is now largely self-sustaining, with established products in the world’s investment markets.

Microfinance targets microenterprises, which represent a family of businesses formed of necessity. Microenterprises serve highly local markets with replicative business models and tends not to employ anyone beyond the owner or their immediate family members. Microenterprises also provides important sources of income for their low income proprietors.

Microenterprises’ cousins, the SMEs, represent a family of businesses that are opportunity driven and comprise a wide variety of business models. SMEs are key generators of formal employment and productivity gains vital for the inclusive economic transformation of emerging economies.

The financing of SMEs, especially in their early stages of development, has not yet received the same level of attention as microfinance, and remains a critical challenge in many countries. Not least because SMEs are the primary drive of productive formal employment which is key to addressing poverty. The International Finance Corporation estimates that SMEs have an unmet financing need of $4.2 trillion.

Significant leverage

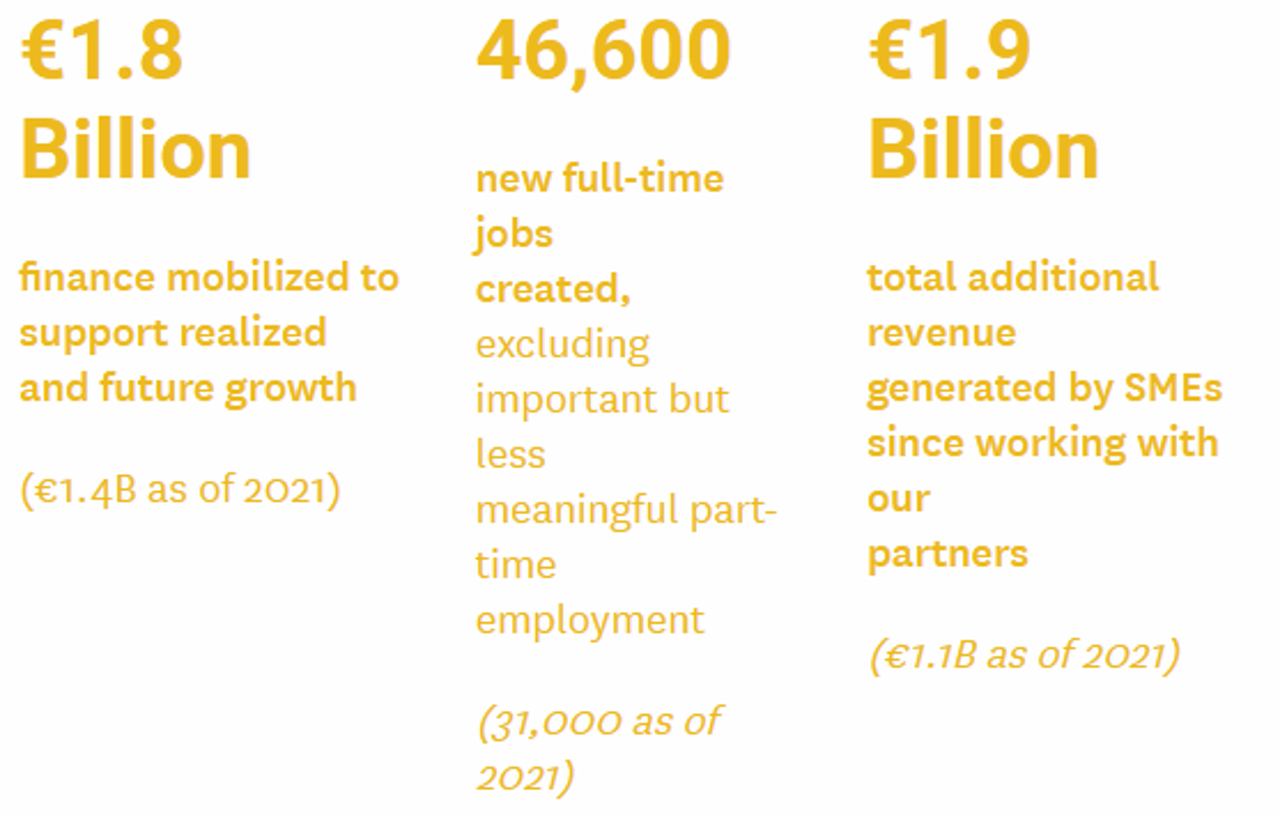

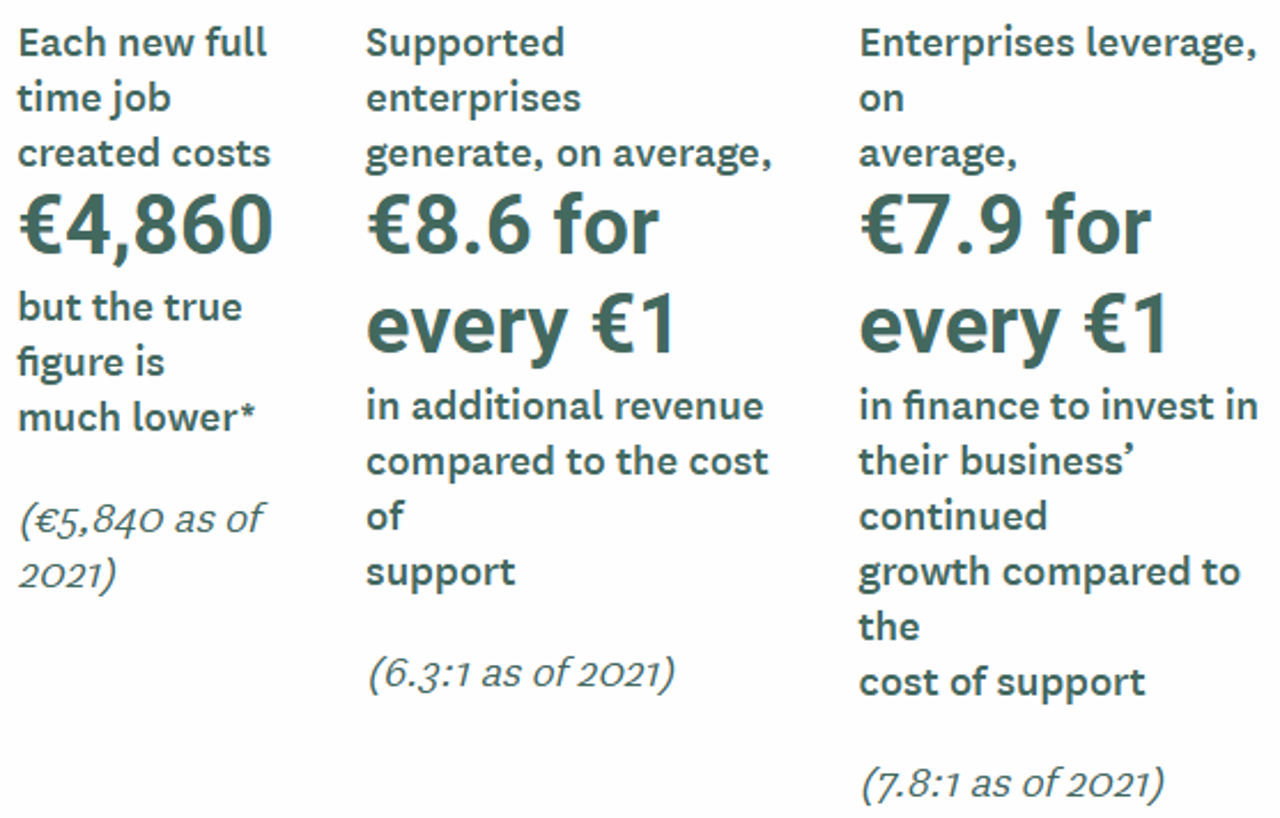

Access to finance has been an important theme as we have sought to understand how entrepreneurs are best supported to grow their enterprises and create new, productive jobs that are so vital in countries with rapidly expanding young populations. Over the last nine years, we’ve funded and collected data from 98 projects implemented by 65 different partner organisations. These projects have worked with 74,500 enterprises and have cumulatively contributed to significant growth: €1.9 billion in incremental revenues; €1.8 billion in finance mobilised to support realised and future growth; and 46,600 new full-time jobs created. Job creation has increased 50% since 2021, a product of both measurement improvements and the delay we see between revenue and headcount growth.

This work, including both Argidius’ contribution, and the contribution of a wide set of co-funders, has cost in total €226 million. This represents a portfolio wide ratio of €7.9 in finance mobilised for every €1 of cost. The ratio jumps to 30:1 when considering Argidius’ sole contribution. Most major development finance institutions achieve a finance leverage ratio of between 0.5 and 2.

Four key lessons

Most of our projects provide non-financial support, such as advice, training and connections. A subset of projects have tackled finance head on, including the establishment of new financial institutions deploying new financial products, or through the renewal of old financial institutions with new financial products. We have seen both success and failure, regardless of the approach. Here are the four key lessons learned:

1. Effective business development services make enterprises investable.

Effective business development services (BDS) that are well targeted and suited to addressing SME needs help entrepreneurs improve their business model, become profitable and generate savings for internal investments.

Internal savings are the cheapest form of investment capital, in markets where interest rates are typically between 10-20%. At the same time, effective BDS make uninvestable enterprises “investable.’’ Such changes include improvements to business models; cost and pricing structures and the ability to sell and to plan.

Many of these enterprises then go on to mobilise external finance with finance providers recognising that the enterprises are more investable. Entrepreneurs have a clearer sense of what type of finance is needed and how much.

Carlos’ story and the support he received from our longstanding partner, TechnoServe, a world leader in effective BDS, points to this.

33% of the members of CEED applied for finance in 2019 and 85% were successful. Evaluation of CEED, 2019

Effective BDS enhance the impact of all types of capital.

2. Banks offer the greatest potential for leverage at scale, but are the hardest to change

KCB Kenya’s SME loan portfolio has grown from €4 million in 2017 to €500 million in 2022, with €2 billion committed for the end of 2027. How? Through a shift in risk scoring SMEs against their cash-flow rather than collateral. The product is their second most profitable, and one of their safest in terms of repayments. The shift was supported by Argidius partnering with the same team, that is now ConsumerCentrix, working with BPR bank in Rwanda. It includes improving outcomes for entrepreneurs such as Jane at New Light Junior Nursery.

A deep market assessment, conducted by Argidius’ partner ConsumerCentrix, enabled KCB to see where the opportunities in the SME market lay, especially with regards to women entrepreneurs for whom collateral is much harder to come by. A relationship management model was developed by ConsumerCentrix so the bank could foster better relationships with SMEs. ConsumerCentrix redesigned the bank’s customer relationship management (CRM) system so that data on deposit-making behaviour could be assessed to inform a new cash-flow based lending methodology. Finally, KCB’s members’ club was transformed into an effective provider of business development services to better meet SME needs.

Not all of our bank projects have turned out so well. Out of 10 projects seeking to transform SME lending, two have worked, two more are promising, and six have, as yet, failed to take off. For example, Alterna’s catalyst fund lay dormant for years before finding a way forwards.

We’ve learned that, given the scope of change needed, projects must align with the strategic interest of a bank, and correspondingly have champions at the highest level. Such projects have a higher likelihood of success if undertaken in the country of a banking group’s headquarters. Market assessment can showcase the opportunity, and segmentation is vital to informing a workable business model and new product design.

Banks operate ancient systems, often patched together following mergers. Significant investment is needed to modify their CRM systems. Banks which are conservative about investment are often not willing to launch out on their own.

In pursuit of a better financing system for all SMEs, we are working with others to shorten the learning curve and accelerate progress. One such example is our knowledge-sharing We-Fi, a $350 million World Bank facility to improve finance for women-led SMEs around the world.

3. National SME investment markets can and need to be intentionally created

Over the last 10 years, Argidius has provided I&P with catalytic grant funding to seed seven funds. Three more are under development.

The impact of these funds are clear as two new SME investment funds recently approached Argidius’ director, Nicholas Colloff, and said they wouldn’t be doing what they’re doing if it hadn’t been for the success of Terenga Capital, Senegal’s first early-stage SME investment fund that was capitalized through contributions from Senegalese pension funds, corporates and I&P. Having modelled that success is possible, others are now seeking to replicate Terenga Capital. Sinergi Burkina is another of the seven country-specific, early-stage SME funds that have been launched by I&P in nascent markets across Africa and which has achieved success.

These funds have raised over €100 million to date, over half from national African investors. They have made equity and quasi equity investments into 55 SMEs and have supported another 81 enterprises in preparation for financing. One of the first investments was into AgroServ, whose story is told in this report. Sinergi Burkina recently completed the successful exit of their investment into AgroServ, having helped the company quadruple revenues and double their headcount. Not only will these funds be generating impact for decades to come, but they will inspire the further development of national SME investment markets, something we already see happening in Senegal.

Starting such funds is long and costly work, which is why catalytic grant capital of the type Argidius provides is so important. Such capital removes set up costs, allowing the fund to work economically. It enables failure, lesson learning and is also patient. It takes time to find and develop the right local talent in what is often a totally new market.

We’ve learned that it’s vital for finance to be accompanied by sound advice, both to enable enterprises to access the finance, and to support enterprises to deploy it effectively. Balloon Ventures, who are profiled in this report, have successfully demonstrated that this advice can be costed into investments, and doesn’t need to take up further grant capital.

Early stage SME investment funds such as Sinergi Burkina, Balloon Ventures, Alterna Catalyst, and IC Fundación are a new phenomena in many markets and face challenges to their own growth and development. Argidius is increasingly lending support to networks, such as the Collaborative For Frontier Finance. They have over 100, predominantly African based funds, in their Early Stage Capital Provider Network. The network enables collective problem solving and advocacy to accelerate the growth and development of these key financiers.

4. Grants are king for the earliest stages

Interest rates in Kenya are in the range of 17% to 25% for SME financing at the time of writing. For entrepreneurs in the earliest stages of establishing their businesses, this level of cost can quickly eat initial profits, especially while business models, costing structures and target customers are being developed. This was a key finding from Balloon Ventures, one of the few financial institutions that has established a commercially viable model able to lend loan sizes of €10k-€100k. Balloon initially focused on very small SMEs, but has since shifted focus to enterprises turning over at least €30k, and more often €100k per annum.

Recognising such challenges, a number of intermediaries have established models which provide grants to entrepreneurs to augment their own initial investments, and those of family and friends. Such grants are embedded within incubation programmes that accompany entrepreneurs in the start-up phase, providing them with knowledge, grant capital, and a network of mentors and peers. Research by the World Bank found large cash-grants, targeted at growth-orientated businesses, have been proven to increase the likelihood of firms having ten or more workers at a good cost-effectiveness (€8,600 cost per job created).

Our partnerships, which include financial partners such as YGap and Villgro, giving cash grants, are testing how cost-effectiveness can be further improved, by exploring what the optimal level of grant is for different enterprise types; how they are best blended with non-financial advice; and whether grants can be converted to equity to contribute to the financial sustainability of intermediaries in cases where enterprises really take off. A winner of this year’s Earthshot Prize, Mukuru Clean Stoves, Africa’s first professional running shoe manufacturer, Enda Sportswear, and a leading home healthcare provider in Kenya, Benacare, all used cash grants provided by Argidius’ partner YGap to help in the formative stages of their enterprises. Collectively these three enterprises, who received grants in the range of €500-€1500, alongside other services including advice, training and connections, have raised more than €2.5 million in follow-on equity investments, employ over 100 full time staff, and in their own ways are contributing to Kenya’s sustainable and inclusive development.

Going forward, we are looking at how to support the continued institutionalisation of well targeted and accompanied cash granting such that it becomes an established offer across SME ecosystems the world over.

Towards effective finance systems for all SMEs

The world’s largest donor for international development assistance recently confessed that: “The missing middle of SME finance is still missing. We’ve been using the same tools for the past twenty years and they are not working.”

Guarantee funds are the tools principally referred to here. These funds assure banks that, if they lend to SMEs, and don’t get repaid, they will not incur financial losses. These tools assume that banks have the right financial products for lending to SMEs, which we have found not to be the case. Such products need to be intentionally designed. In fact, a wide array of effective financial products are required to address the varied capital needs constraining the growth of SMEs, including factoring, trade finance, leasing, supply chain finance, working capital and capital expenditure. Such products need to be deployed by a wide array of financial institutions which have a good understanding of their clients.

In this chapter, we’ve highlighted green shoots for addressing the missing middle finance challenge for SMEs; we’ve highlighted some of the actors propagating these shoots; and we’ve demonstrated ways in which grant capital is catalytic in leveraging significant flows of further investment, often from local sources. Going forward, we seek to nurture these advances, encourage our allies in larger funding institutions to replicate these successes, and together build a wider array of products effectively financing the full gamut of SMEs. In doing so we will fill in another piece of the puzzle for lower income countries to harness the power of SMEs to transform their economies and make major progress against poverty.